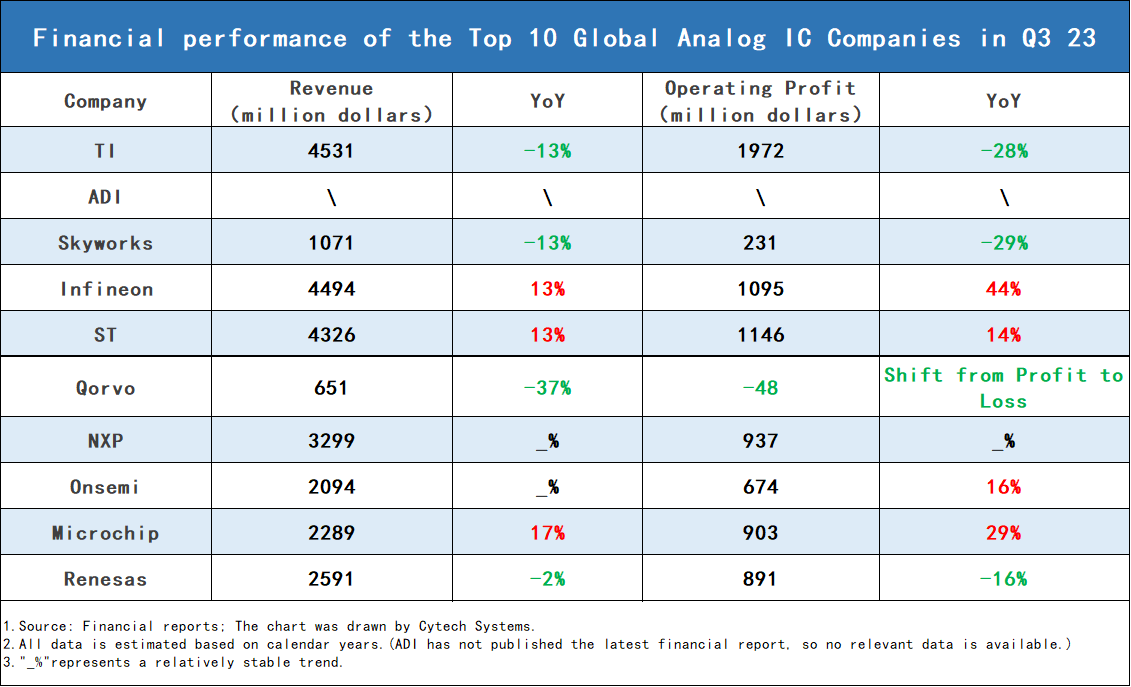

Analyzing Q2 Financial Reports of the Top 10 Global Analog IC Companies to Uncover Market Trends

The top 10 global analog IC companies continued to experience a trend of diverse performance in Q2 2023.Infineon, STMicroelectronics, and Microchip achieved year-on-year growth in Q2 revenue and operating profits, benefiting from the sustained expansion in automotive, industrial, and renewable energy sectors. However, companies such as Texas Instruments, Skyworks, Qorvo, and Renesas experienced decreases in both Q2 revenue and operating profits due to limited demand in sectors like consumer electronics and communication. NXP and Onsemi maintained relatively stable Q2 revenues compared to the same period in the previous year.

The consumer market has passed its lowest point, while the automotive and industrial sectors continue to maintain growth.

The revenue growth of several top global analog IC companies remains driven by the expansion in automotive, industrial, and renewable energy businesses, although this growth is partially balanced by a reduction in revenue from the consumer electronics segment. Even in the case of significant performance decline, Texas Instruments still affirms that all terminal markets exhibit weakness, except for the automotive market.

The Q2 financial reports of analog IC companies indicate changes within the consumer electronics sector. Texas Instruments announced that personal electronics was up low-single digits, after several quarters of sequential declines. NXP is successfully navigating through the cyclical downturn in its consumer-exposed businesses. For Renesas, PC and consumer sales are still largely down compared to the previous year, but they will bottom out in Q2, almost as expected. The company expect moderate growth, or rather recovery, from Q3 onward.

The automotive and industrial markets continue to maintain strength; nevertheless, there are concerns. Renesas currently expect that the pace of growth will slow down for industrial applications, which have been very strong so far, although they will continue to grow YoY. The company also expresses confusion regarding the automotive demand, primarily due to two major factors. One is the rapid growth of EVs in China and the corresponding decline in internal combustion engines, which has led to this uncertainty, especially among Japanese customers. Another factor is the tight cash flow situation among their major global Tier 1 customers, leading them to manage their inventory meticulously.

Infineon holds a more optimistic outlook for the automotive industry. Infineon believes that further revenue step-up primarily driven by microcontrollers and strong demand in e-mobility in automotive sector and product categories like MCUs and high voltage semiconductors remain rather tight, while structural growth trends are intact.

With concerns over the continuous increase in inventory, some of them are taking steps to avoid it.

Both inventory levels and days of inventory (DOI) have witnessed a continuous increase over several quarters within analog IC sector. Ongoing inventory adjustments in end-customers and channels, along with a slow recovery in sectors like consumer electronics and communication, have contributed to the ongoing ascent of analog IC companies' inventory throughout the second quarter of this year.

Among the top ten analog IC companies, the inventories of most companies increased compared to the previous quarter, with only Renesas and Skyworks experiencing a decrease in inventory.

Renesas' DOI for Q2 decreased to 102 days from 107 days in Q1. The change can be attributed to production adjustments. According to the company’s quarter report, The utilization rate of production line was in the low 60% range in Q2, resulting in a slightly lower-than expected decline. For Q3, the company expected the utilization rate to remain mostly flat from that in Q2.

During Q2, Texas Instruments' DOI has risen to 207 days, marking an increase of 12 days compared to the previous quarter. Texas Instruments forecast an upward trend in company inventory in short time. However, the company has not conveyed intentions to control production; instead, it is focusing more on considering the long-term supply.

Foreseeably, destocking efforts in the analog IC sector will continue in the latter half of the year. As multiple leading companies further reduce production line utilization to control inventory, coupled with the continued recovery in the consumer electronics domain, and with the sustained momentum from automotive and industrial sectors, the inflection point of the inventory cycle is drawing closer.

-

Previous

The AI server boom is accelerating the memory industry into a rebound

- No More